Mortgage affordability calculator self employed

When you work for someone else lenders go to your. Get a sense of how much you can afford to borrow and what makes sense for you.

Residential Construction Budget Template Excel Inspirational 15 Bud Spreadsheet Exc Household Budget Template Budget Planner Template Budget Template Printable

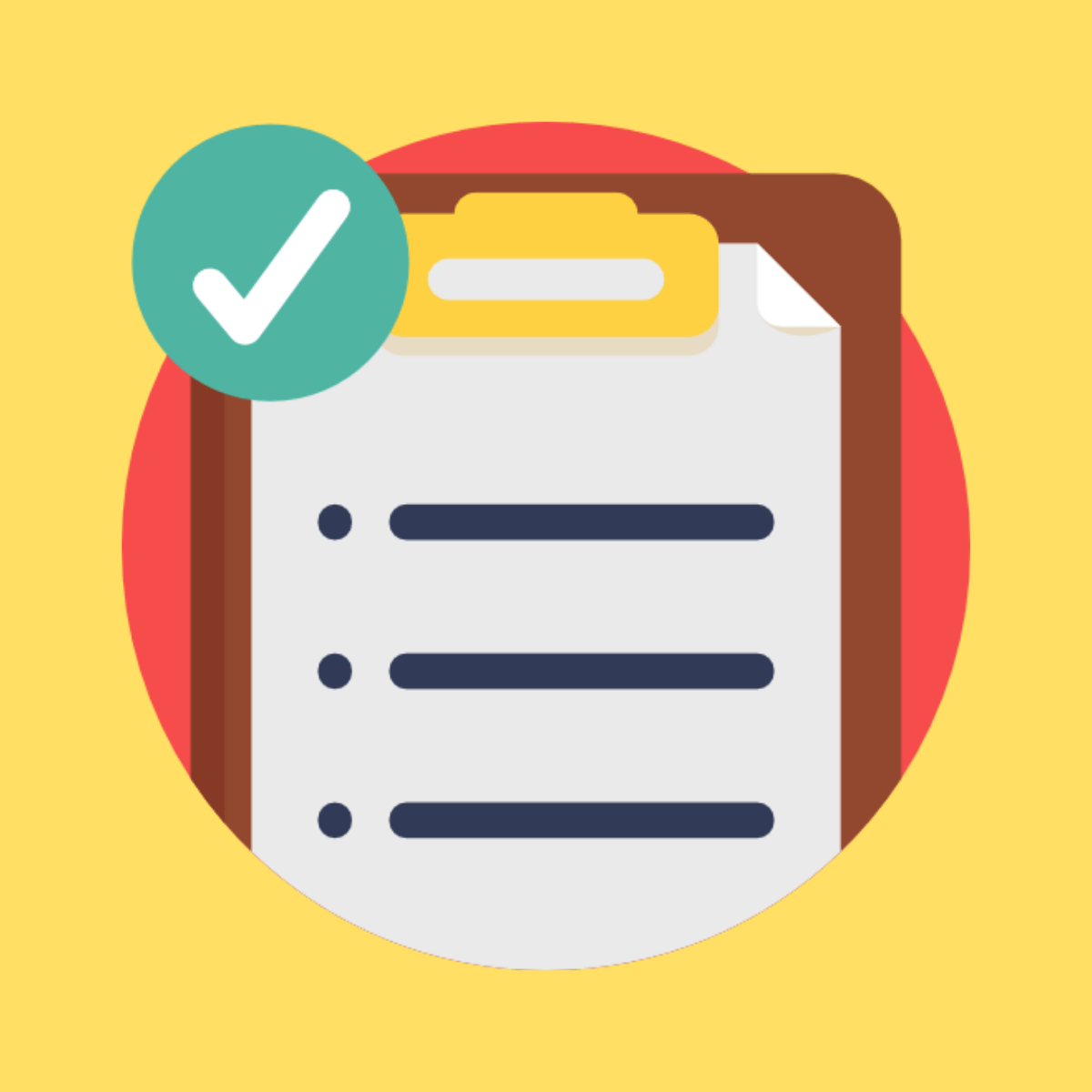

Use our free home affordability calculator to estimate how much home you can afford.

. Find a mortgage that fits your budget based on your monthly income and expenses. Use our MoneyHelper mortgage affordability calculator to find out how much you can afford to borrow for your new house. Our Mortgage Calculator Will Give You The Best Competitive Mortgage Rate.

Self-employed people pay self-employment taxes which had them paying both halves of the tax. The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. Please be aware that this is only an indication of how much you could borrow.

Property Purchase Price. Remember as a self-employed individual you are considered as both the employerbusiness and the employee. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Please only include commitments that will remain after completion ie. On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000. Results of the mortgage affordability estimateprequalification are guidelines.

Income 1 Income 2 Multiple Amount. If youre self-employed you may have some extra steps when buying a home. Please note our affordability calculator is only for guidance purposes.

See how much your payments could be if you make weekly bi-weekly or monthly payments. Guiding you through the Mortgage Maze. The maximum loan available may be impacted by the Loan to Value and may be lower than the amount displayed as a result of the limited information captured in the calculator.

Repayments Interest only. 0345 602 7021 Hours. Self employed clients - Sole traders and Partnerships only.

First Time UK Expat and Foreign National Investors Emboldened by Relaxed Mortgage Affordability Rules. First banks implement a stress test to make sure that your repayment must still be within TDSR constraints even if interest rates rise to 35. Mortgage Affordability Calculator - for new business only.

Find out how much you may be able to borrow based on your employment status and annual income. Were committed to providing you with a quality service so calls may be recorded or. Land transfer tax calculator.

Self-employed people need to show additional. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Alternatively for straightforward cases you can get a quick indication of how much Nationwide could lend by using the quick quote calculator on nationwidecouk.

Medicare and Social Security tax rates are doubled for the Self-employed are currently equal to 153 Self-employment taxes must be paid if at least 40000 are earned in net profit throughout the year. The Share to Buy affordability calculator is based on the results obtained from a range of mortgage lenders own calculators and it therefore indicative and should be used for guidance only. Due to the variation in lenders calculators and credit scoring a result showing a mortgage loan is affordable does not mean that you will necessarily be.

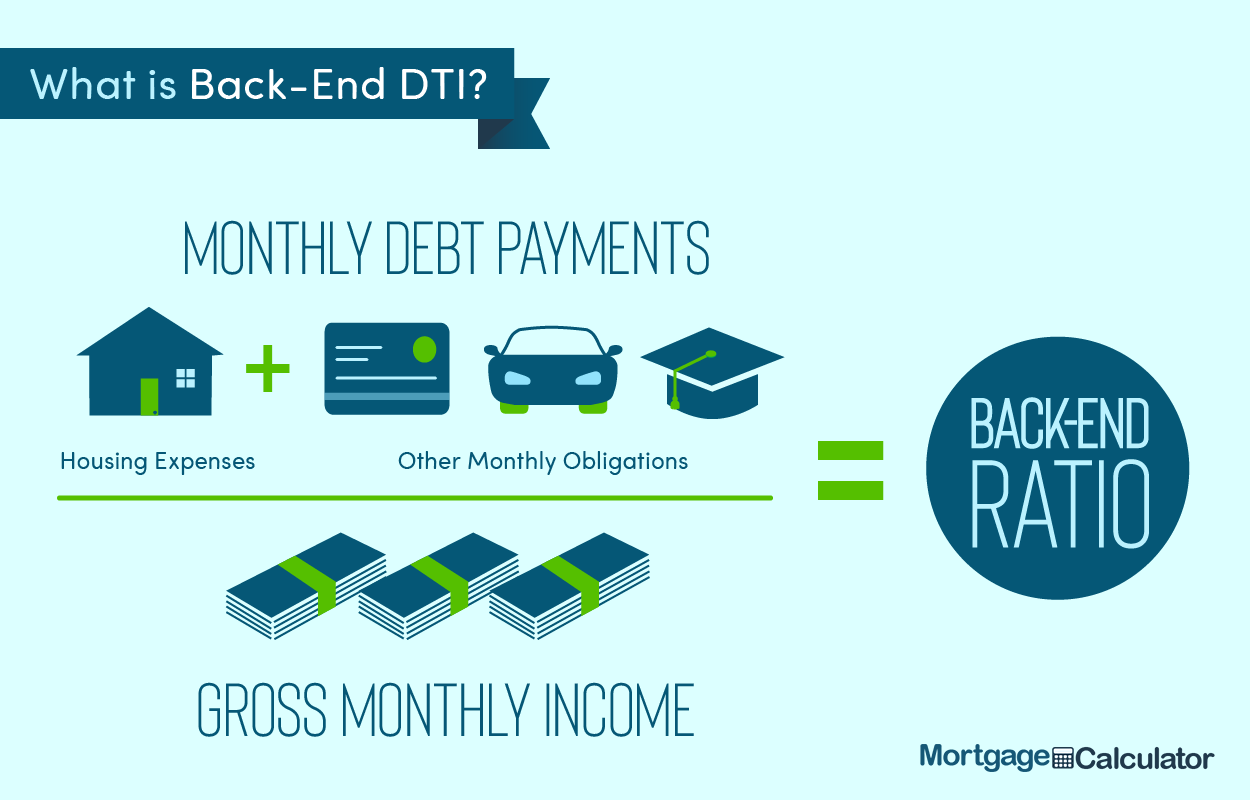

The actual amount is based on a number of things including your salary credit rating and how much you can afford to repay after all your. This calculator should not be used for additional lending portability or transfers of equity. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

Income and affordability calculations and also what it will cost. What Mortgage Can I Afford Calculator. To give your clients an estimate of how much their property is worth today.

Please see our Criteria Affordability and Sustainability section for more information. For a thorough calculation of how much your client may be able to borrow fill in the full affordability calculator below. Mortgage refinancing is when a homeowner takes out another loan to pay offand replacetheir original mortgage.

Self employed Contractors. Sat Sun and bank holidays. 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower would be unable to repay the reversion rate on the loan if the rate increased by 3.

First-time home buyer How to use this mortgage calculator. 2836 are historical mortgage industry standers which are. How to buy a house with 0 down.

Or 4 times your joint income if youre applying for a mortgage. Self Employed. Your credit score how much debt you have your assets and your income.

Any Questions Call Our Expert Team On 44 0 161 871 1216. Please include the total monthly figure for. Page description Max 155 characters Leeds Building Society.

A mortgage refinance calculator can help borrowers estimate their new monthly. Please state the clients share. Find out what you can borrow.

Second if you are a self-employed individual and have variable income rather than a fixed one your income will be reduced by 30 in. Calls from the UK are free. For 2020 the FICA limit is on the first 137700 of income.

The estimate is. Affordability can only be assessed on submission of a full application for this type of lending. For those who are self-employed you must provide additional documentation such as bank statements.

If consolidating debts dont include them in this section. Use our self-employed mortgage calculator today. Mortgage or secured loans unsecured loans credit or store cards overdrafts school fees maintenance payments and student loans.

Calculate the amount you will have to pay in land transfer tax depending on your location. When youre self-employed and you want to buy a home you fill out the same mortgage application as everyone elseMortgage L lenders also consider the same things when youre a self-employed borrower. 1-2 years of consistent employment history most likely two years if self-employed A property that meets FHA standards or is eligible for FHA 203k financing A loan amount within 2022 FHA loan.

UK Limited Company Mortgages. This mortgage payment calculator will help you find the cost of homeownership at todays.

Self Employed Mortgage Calculator Haysto

Mortgage Documents Checklist Loans Canada

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Home Refinance

Mortgage Affordability Loans Canada

9 Free House Affordability Calculators And How To Use Them

Self Employed Mortgage Options Qualifications Wowa Ca

Attention Home Buyers Stop Renting Start Investing How Much Rent Did You Pay In The Last Few Years Why Pay Your La Mortgage Brokers Mortgage Home Inspector

Mortgage Affordability Loans Canada

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

9 Free House Affordability Calculators And How To Use Them

Self Employed Mortgage Calculator Haysto

Mortgage Affordability Calculator 2022

Mortgage Payment Rate Calculators True North Mortgage

Mortgage Calculators Ryan W Smith House Home Mortgage Co

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Home Equity Loan Mortgage Calculator Your Equity

How To Get A Mortgage With Bad Credit Comparewise